DeFi Sniper Bot: A Tool for Precision Trading in Decentralized Finance

페이지 정보

작성자 Percy Cortes 작성일24-10-16 18:31 조회2회 댓글0건본문

What is a Telegram Snipe Bot?

A Telegram snipe bot is an automated trading bot that operates through the Telegram platform, typically through specific bot sniper crypto commands or integrations with Telegram groups dedicated to cryptocurrency trading. These bots are programmed to execute trades the moment a token is listed on decentralized exchanges (DEXs) such as Uniswap or pancakeswap sniping bot PancakeSwap, crypto bot pancakeswap allowing traders to get in on the action faster than they could manually.

Given the highly volatile nature of the cryptocurrency market, particularly with newly listed tokens, the ability to buy tokens within seconds of their launch can make a significant difference in profitability. Traders use these bots to "snipe" tokens—purchasing them immediately after they become available to capture gains before prices rise due to high demand.

Given the highly volatile nature of the cryptocurrency market, particularly with newly listed tokens, the ability to buy tokens within seconds of their launch can make a significant difference in profitability. Traders use these bots to "snipe" tokens—purchasing them immediately after they become available to capture gains before prices rise due to high demand.

Positioning: They place trades in optimal positions, ahead of large market moves.

Profit Potential: By getting in before big price swings, these bots can lock in profits that would be difficult to achieve manually.

What Are Sandwich Bots?

While this growth has created opportunities for investors and crypto sniper bot crypto bot traders, it has also led to the rise of automated trading strategies like front-running bots, which take advantage of inefficiencies and high-speed execution to profit from other traders. The cryptocurrency market has seen incredible growth over the past decade, with decentralized finance (DeFi) platforms becoming increasingly popular.

This gives them a significant advantage in highly competitive markets.

Accuracy: Bots can be programmed to follow precise trading strategies, reducing the risk of human error. Speed: Sniping bots can execute trades at speeds that are simply unattainable for human traders.

Executing the Trade: Once the opportunity is detected, the bot executes the trade, capturing the MEV by manipulating the transaction order. This process can be completed in milliseconds, making it highly efficient and profitable for the bot operator.

Since miners control which transactions are included in a block and in what order, they have the power to optimize the transaction sequence to their benefit. This may include strategies like front-running, back-running, or sandwich attacks. What is MEV?

Miner Extractable Value (MEV) is the value that can be captured by miners or validators by influencing the order in which transactions are processed in a block.

As a result, the original trader pays a higher price than anticipated, reducing their potential profit or leading to losses. Increased Costs for Regular Traders

Front-running bots often force legitimate traders to pay more for tokens or lose out on favorable trades. When a bot front-runs a transaction, it drives up the price of a token before the original trade can be executed.

These might include large trades that could shift the price of a token. Key Steps of a Front-Running Bot:

Monitor the Mempool: The bot continuously scans the mempool for large or profitable transactions that are about to be executed on a DEX.

Profit-Taking Mechanism: Many DeFi sniper bots are also programmed to automatically sell tokens once they’ve reached a certain profit margin. This feature helps traders lock in profits without constantly monitoring the market.

This phenomenon has given rise to MEV bots, which are sophisticated tools used to exploit these opportunities and generate significant profits. In the world of decentralized finance (DeFi), where speed, automation, and transparency define the trading landscape, the concept of Miner Extractable Value (MEV) has become a hot topic. MEV refers to the additional profits that miners (or validators in proof-of-stake systems) can extract from blockchain transactions by prioritizing, reordering, or censoring transactions within a block.

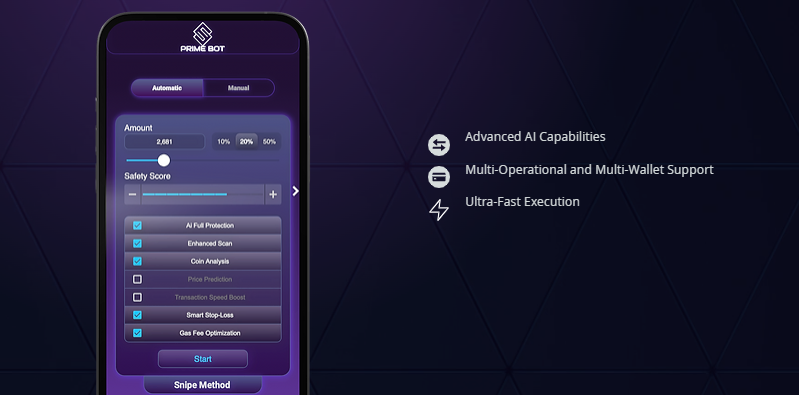

A Telegram snipe bot is an automated tool designed to help traders execute trades with precision and speed, often during critical moments such as token launches or significant market events. As the cryptocurrency market grows increasingly competitive and fast-paced, crypto sniping bot reddit traders are constantly seeking tools to gain an edge in executing timely and profitable trades. One such tool that has gained popularity is the snipe bot, particularly in Telegram, a platform known for its use by crypto communities.

A sniper bot crypto bot monitors blockchain data in real-time, identifying when a new token is listed and automatically placing a buy order at lightning speed. It is so fast that it often outperforms manual traders, getting in at the lowest possible price. This is where sniper bot crypto bots come in. In essence, sniper bot crypto bots are programmed to strike quickly and efficiently—"sniping" tokens at the best possible moment.

Analyzing Profitable Opportunities: The bot uses algorithms to determine which transactions can be exploited for MEV. For example, if it detects a large buy order that is likely to drive up a token's price, it might place its own buy order ahead of the original transaction (front-running) and then sell the tokens for a quick profit.

A Telegram snipe bot is an automated trading bot that operates through the Telegram platform, typically through specific bot sniper crypto commands or integrations with Telegram groups dedicated to cryptocurrency trading. These bots are programmed to execute trades the moment a token is listed on decentralized exchanges (DEXs) such as Uniswap or pancakeswap sniping bot PancakeSwap, crypto bot pancakeswap allowing traders to get in on the action faster than they could manually.

Positioning: They place trades in optimal positions, ahead of large market moves.

Profit Potential: By getting in before big price swings, these bots can lock in profits that would be difficult to achieve manually.

What Are Sandwich Bots?

While this growth has created opportunities for investors and crypto sniper bot crypto bot traders, it has also led to the rise of automated trading strategies like front-running bots, which take advantage of inefficiencies and high-speed execution to profit from other traders. The cryptocurrency market has seen incredible growth over the past decade, with decentralized finance (DeFi) platforms becoming increasingly popular.

This gives them a significant advantage in highly competitive markets.

Accuracy: Bots can be programmed to follow precise trading strategies, reducing the risk of human error. Speed: Sniping bots can execute trades at speeds that are simply unattainable for human traders.

Executing the Trade: Once the opportunity is detected, the bot executes the trade, capturing the MEV by manipulating the transaction order. This process can be completed in milliseconds, making it highly efficient and profitable for the bot operator.

Since miners control which transactions are included in a block and in what order, they have the power to optimize the transaction sequence to their benefit. This may include strategies like front-running, back-running, or sandwich attacks. What is MEV?

Miner Extractable Value (MEV) is the value that can be captured by miners or validators by influencing the order in which transactions are processed in a block.

As a result, the original trader pays a higher price than anticipated, reducing their potential profit or leading to losses. Increased Costs for Regular Traders

Front-running bots often force legitimate traders to pay more for tokens or lose out on favorable trades. When a bot front-runs a transaction, it drives up the price of a token before the original trade can be executed.

These might include large trades that could shift the price of a token. Key Steps of a Front-Running Bot:

Monitor the Mempool: The bot continuously scans the mempool for large or profitable transactions that are about to be executed on a DEX.

Profit-Taking Mechanism: Many DeFi sniper bots are also programmed to automatically sell tokens once they’ve reached a certain profit margin. This feature helps traders lock in profits without constantly monitoring the market.

This phenomenon has given rise to MEV bots, which are sophisticated tools used to exploit these opportunities and generate significant profits. In the world of decentralized finance (DeFi), where speed, automation, and transparency define the trading landscape, the concept of Miner Extractable Value (MEV) has become a hot topic. MEV refers to the additional profits that miners (or validators in proof-of-stake systems) can extract from blockchain transactions by prioritizing, reordering, or censoring transactions within a block.

A Telegram snipe bot is an automated tool designed to help traders execute trades with precision and speed, often during critical moments such as token launches or significant market events. As the cryptocurrency market grows increasingly competitive and fast-paced, crypto sniping bot reddit traders are constantly seeking tools to gain an edge in executing timely and profitable trades. One such tool that has gained popularity is the snipe bot, particularly in Telegram, a platform known for its use by crypto communities.

A sniper bot crypto bot monitors blockchain data in real-time, identifying when a new token is listed and automatically placing a buy order at lightning speed. It is so fast that it often outperforms manual traders, getting in at the lowest possible price. This is where sniper bot crypto bots come in. In essence, sniper bot crypto bots are programmed to strike quickly and efficiently—"sniping" tokens at the best possible moment.

Analyzing Profitable Opportunities: The bot uses algorithms to determine which transactions can be exploited for MEV. For example, if it detects a large buy order that is likely to drive up a token's price, it might place its own buy order ahead of the original transaction (front-running) and then sell the tokens for a quick profit.

댓글목록

등록된 댓글이 없습니다.

HOME ▶ 커뮤니티 ▶ 상담문의

HOME ▶ 커뮤니티 ▶ 상담문의